South Carolina State Business

Tax Extension

Businesses must report their income and expenses to the state of South Carolina.

If the businesses need more time to prepare and file state business income tax returns, they can extend the deadline for up to 6 months.

South Carolina Requires Businesses to file tax extension Form SC1120-T to obtain a tax extension. If you don't have to pay any taxes for South Carolina and have approved Form 7004 by the IRS, the State grants a 6 months automatic extension to file your business tax return.

Learn More about South Carolina State Business Tax Extension

South Carolina State E-filing Deadline for 2020 Tax year

Form W2

W2 South Carolina tax returns are due by

January 31, 2021..

Form 1099

1099 South Carolina tax returns are due by

January 31, 2021..

Information About South Carolina

State Filings

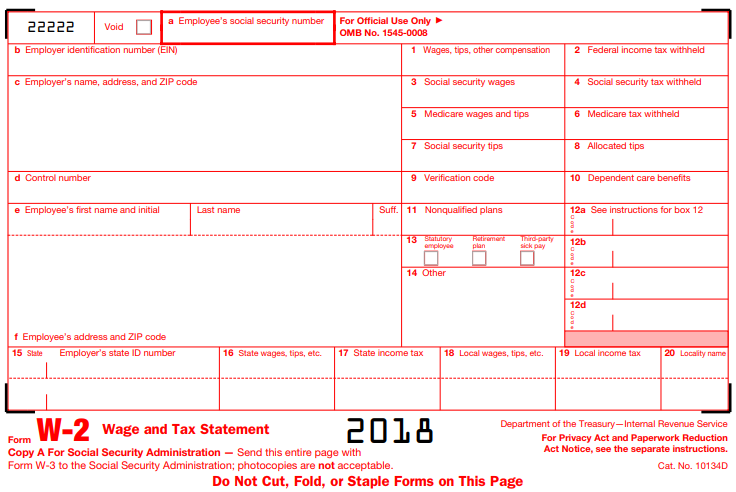

Form W-2

The state of South Carolina mandates the filing of SC Withholding Fourth Quarter and Annual Reconciliation WH-1606 along with your W2 Form. Form W-2 is used to report wages paid to employees and the taxes withheld from them. You must file Form W2 even if there is no state tax withholding. Click here learn more about W2 Form.

Form WH-1606 - SC Fourth Quarter &

Annual Reconciliation Form

The Form WH-1606 return must be filed even if there are no reportable wages or taxes due for the reporting period.

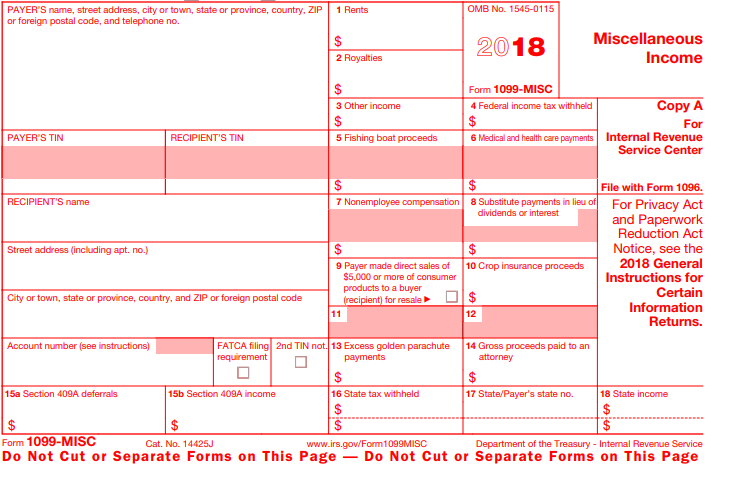

Form 1099

The state of South Carolina requires the filing of SC Withholding Fourth Quarter and Annual Reconciliation WH-1606 along with your 1099 Forms. This state participates in the CF/SF program, but you are still required to submit your 1099 forms directly with the state. There are differnt types of Forms available such as MISC, INT, DIV, R, S, B which are report various types of income like non employee compensation, rents, interest and dividends incomes etc. Click here to learn more about 1099 Forms.

File the below required 1099 forms to the state only if there was state tax withholding.

- Form 1099-MISC

- Form 1099-DIV

- Form 1099-R

South Carolina State Filing Requirements

Form W-2

In order to complete the South Carolina W2 Form you need the following information:

-

Employer Details: Name, EIN, Employer Code, Employer Type,

and Address. - Employee Details: Name, SSN, Address, and Contact Information.

- Federal Details: Federal Income and Federal Taxes Withheld.

-

South Carolina State Filing Details: State Income and

State Taxes Withheld.

Form 1099

In order to complete the South Carolina 1099 Form you need the following information:

- Payer Details: Name, EIN/SSN,

and Address. - Recipient Details: Name, EIN/SSN, and address.

- Federal Details: Miscellaneous Income and Federal Taxes Withheld.

- South Carolina State Filing Details: State Income and

State Taxes Withheld.

Why You Should EFile?

- By E-filing you can avoid the hassle of paper work and you will receive an notifications via email.

- E-filing of forms can be done at any time and

from anywhere. - Another major advantage of e-filing is that allows you to access your records easily, and keep them stored in one place.

- Efile your safely from your home or office, this is a perfect option for employers that are still operating remotely.

- E-filing offers built-in error checks that will catch any inconsistencies and incomplete fields when filling the forms..

Why is southcarolinataxfilings.com the best option for W2 & 1099 E-filing?

Southcarolinataxfilings.com helps you to file the Form W2 & 1099 information returns online in minimal time and provides you with the following features:

- Error-free E-filing.

- Bulk Upload (Employer / Employee information)

- Bulk Filing the Forms to both the Federal & State.

- We Print and Mail copies.

- E-filing of Prior-year Tax Returns.

- Status update of your E-filed Returns.

For E-Filing, pricing starts as low as $1.49 per form. Click here to learn more about pricing.

Steps To Efile W2 & 1099 Forms for the State of South Carolina

free account.

State tax details.

Contact Us

The Southcarolinataxfilings Team is standing by to assist you.

Give us a (704) 684-4751 or

support@TaxBandits.com.

Interested in learning more about South Carolina Tax Returns? Click the button below and one of our team members will get in touch with you soon.